NEWS

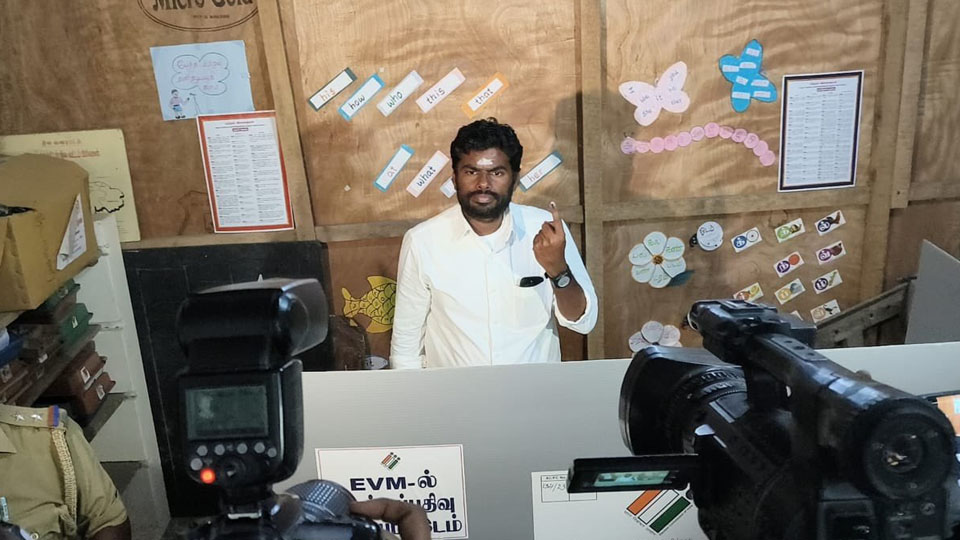

Lok Sabha Election-2024: First phase of polling begins

Defective EVM machines replaced with reserve units

Postal ballot voting commences in city

Party worker killed by speeding car: Ban orders to prevent untoward incidents in four Kodagu villages

Bangalore Palace land acquisition for road widening: Mysore Royal Family to get Rs. 1,400 cr. in TDR

KRS Dam water pumped out for VC Canal works

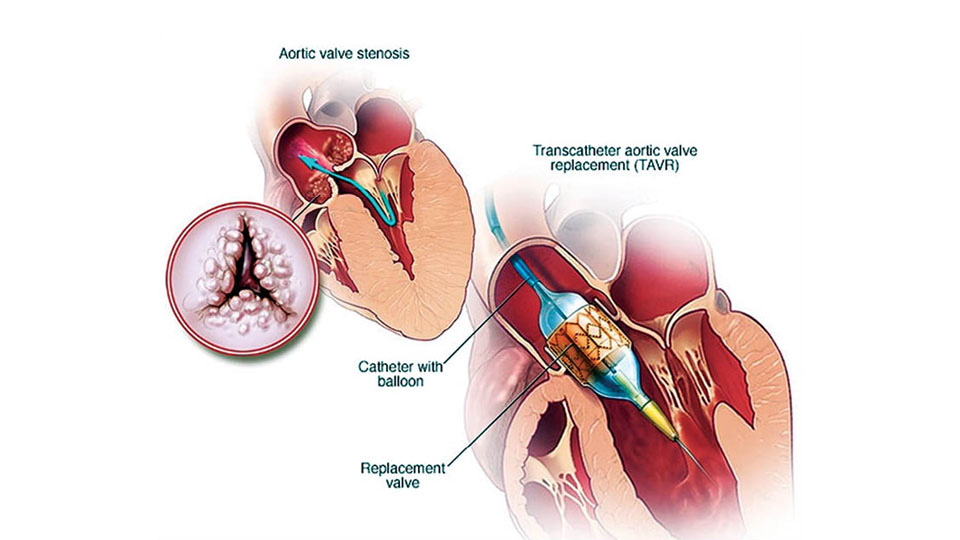

HEALTH CAPSULE

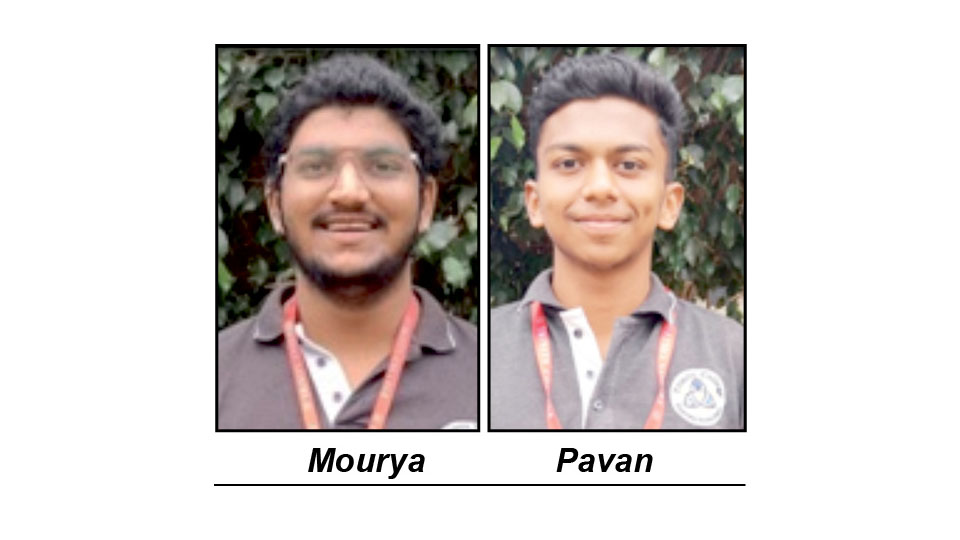

TEASER

Recent Comments