The pension received in the hands of the pensioners is taxable under the Income-Tax Act, 1961. The pensioner whose income after allowing certain deductions, exemptions or allowances or set-off of certain loss as per the provisions of the Act crosses rupees two lakh fifty thousand up to the age of 60 years, rupees three lakh between the age of 60-80 years and rupees five lakh beyond 80 years of age, shall be liable to pay Income Tax accordingly.

The pensioner shall furnish valid Income Tax Permanent Account Number (PAN) and details of certain deductions, exemptions or allowances or set-off of certain loss to the banks in prescribed Form 12BB.

The pensioners, who are paid pension from a Nationalised Bank, shall demand Form 16 from the concerned bank branch.

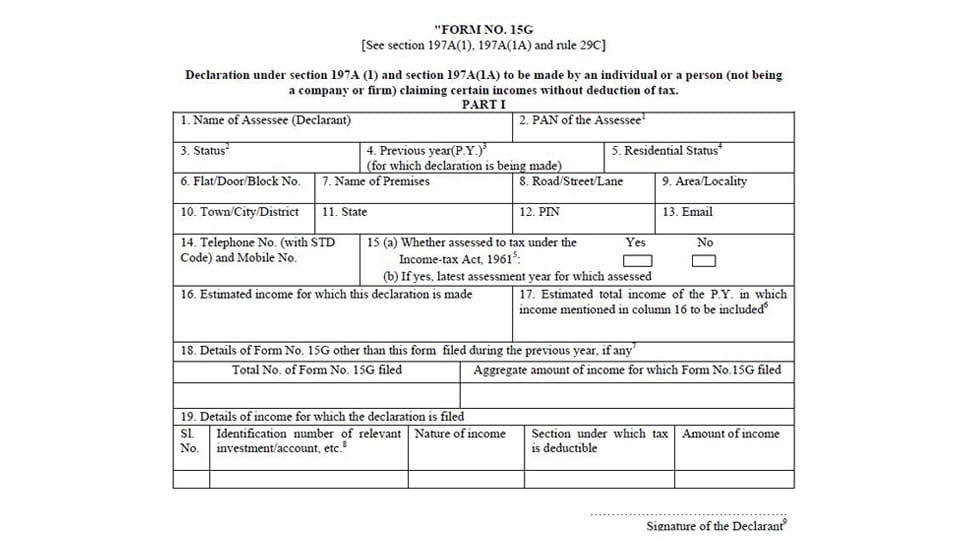

Any person, who gives the Declaration either in Form G or Form H claiming certain incomes from without deduction of tax where their income crosses the limit as mentioned above from the payer, shall read the declaration properly before signing and submission. False declaration will attract rigorous imprisonment which shall not be less than three months but which may extend to two years with fine.

The Form 15G or Form 15H conditions are applicable to any income receivable: example Salary, Pension, Rent, Interest, Insurance Claims, Commission, contract amount, etc. This declaration shall be made only by an individual.

The person responsible for paying the income shall NOT accept where the amount of income exceeds the maximum amount which not chargeable to tax after allowing certain deductions, exemptions or allowances or set-off of certain loss as per the Act.

—N.D. Shreenivaas, Bhavani Associates

Column no.4 of form 15 H or G is confusing!

Why do they call it as Previous year instead of just telling Financial Year.?

The bank authorities just ask their customers to sign in two places of the form while insisting only PAN no. and Customer ID. All other forms need not be filled according to Banks. Is this correct?

Why waste such lengthy forms ?

Dear Mr. Shreeneewas,

Namaskar !

You have written that The Form 15G or Form 15H conditions are applicable to any income receivable: example Salary, Pension, Rent, Interest, Insurance Claims, Commission, contract amount, etc. This declaration shall be made only by an individual.

But section 197A does not refer to section 192 regarding Salary or Pension. Now whether a Pensioner or Salaried person can submit Form 15G or 15H ? If yes, under which Section ?