The versatility of options trading provides plenty of opportunities in the stock market. Traders can adjust their approach to options trading to match their individual goals and specific investment objectives. In this article, we’ll go over three different option trading methods that can aid investors in minimizing losses and maximizing gains.

Collar Strategy

Investors whose primary concern is the potential loss of a stock holding sometimes employ a collar strategy. The collar strategy involves purchasing an underlying asset for investment, such as stocks, while concurrently purchasing a put option to limit the downside risk and selling a higher call option to earn income and restrict the upside potential. Investors whose wealth is concentrated in a single stock position and who may be unable to diversify away from that position may find collar strategy particularly appealing. However, this technique also comes with a limited form of loss and a limited level of profit. The insurance cost can be reduced by writing a call option, making collar methods appealing.

Investors looking to employ the collar strategy may need to keep up-to-date with events that may affect the price of underlying assets. A valuable tool is the economic calendar, which can identify economic events such as economic reports, corporate earnings announcements, or central bank policy decisions that may affect underlying asset prices. The economic calendar shows every financial event and economic indicator influencing stocks and Forex. Investors can use this information to adjust the collar strategy by selecting appropriate strike prices for the put and call options or by avoiding the timing of the trend to escape potential volatility.

Covered Call Or Income Generation Strategies

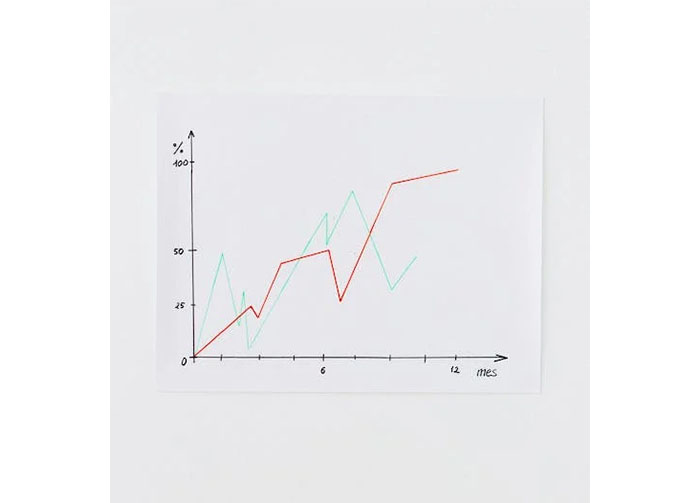

When a stock is expected to remain relatively unchanged for an extended period, investors can employ a strategy known as covered calls or buy-write to cut down on their holding costs. Rather than letting the stock sit dormant, an investor may sell higher call options, allowing them to earn the cost of the premium while simultaneously lowering the costs associated with owning the stock.

For instance, a stock purchased for a long-term purpose may fall below the call option’s strike price. Thus, the investor may sell off higher calls and generate revenue from the premium. Contrarily, if the stock price rises above the strike price, the investor will most likely sell the stock but incur more losses. However, a covered call is a safe bet for investors who wish to make money while keeping shares of a business they think will stay reasonably steady.

Source: Pexels

The Long Straddle Strategy

The long straddle is an options trading technique that involves a high degree of risk. It is a plan meant to be profitable when the stock is very volatile and moves rapidly up or down. Hence the long straddle allows you to purchase two options (a call option and a put option) on the same stock at the same strike price and expiration date. If the stock price drastically shifts, the strategy benefits since one option’s value will rise while the other’s falls.

This technique provides a greater potential for reward, but only a substantial change in the stock price will make it worthwhile. Therefore, only seasoned traders who can tolerate greater uncertainty should utilize it.

Options trading can be tailored to the goals and risk tolerance of the investor through the use of the collar, covered call/income generating, and long straddle techniques.

Recent Comments