By Bhamy Shenoy, IIT-Madras, Oil Industry Expert

Congress Party, with the support of other Opposition parties, organised a nationwide Bharat Bandh yesterday, September 10, 2018, to protest against the price rise in petrol and diesel. Congress claimed that NDA has “looted” Rs. 11 lakh crore from “common man” by imposing high taxes on petroleum products. Most opposition parties supported the initiative of the Congress Party.

Coinciding with this development, India Today’s article titled, “Why Indian government exports petrol at half the price we pay” has caught the attention of the public.

As expected, the ruling party coalition NDA blames the price rise on international oil price increase, devaluation of rupee and also points finger at State governments (whose taxes increase with oil price unlike that of the Central government) who are unwilling to reduce their taxes.

In Karnataka, when the Congress Party demanded the reduction of petrol taxes, its partner JD(S) refused since it wants revenues to write off farmer loans.

Because of all these different developments, it is but natural that there is total confusion about petrol price rise.

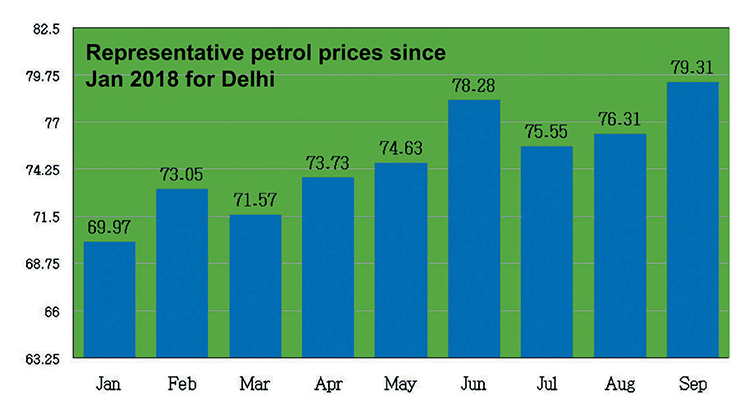

As shown in the chart of petrol price since the beginning of 2018, current petrol price is marginally higher than what it was three months back in June. Still the Congress Party decided to launch an aggressive campaign against the price rise. When petrol price reached historic high in May, Opposition parties led by former Finance Minister P. Chidambaram stated that NDA can reduce petrol price by Rs. 25 per litre. Only a magician could have pulled that trick without hurting the economy.

During the UPA rule between 2005-06 and 2013-14 (10 years), it incurred a loss of Rs. 4.3 trillion by selling petrol and diesel below cost while NDA collected additional revenues of Rs. 4.4 trillion during its four- year rule. NDA was able to do this since it increased Central duty for petrol from Rs.9.48 per litre to Rs. 19.48 and for diesel from Rs. 3.56 per litre to Rs. 15.33 per litre in small doses.

It is not a loot as claimed by Congress Party

However, to refer to the collection of taxes on petrol and diesel as loot and saying that Indian government is exporting petrol at half the price to that of what we pay here is a perfect example of “fake news.”

On the surface, they look like the narratives based on facts. However, the implied suggestion by the “fake news” industry that NDA government is acting irresponsibly, is far from truth. I am boldly making this statement even at the risk of being criticised as an NDA “bhakta.” But earlier, I was highly critical of NDA when it forced ONGC to buy a loss-making Gujarat National Petroleum Company and also its irrational gas policy.

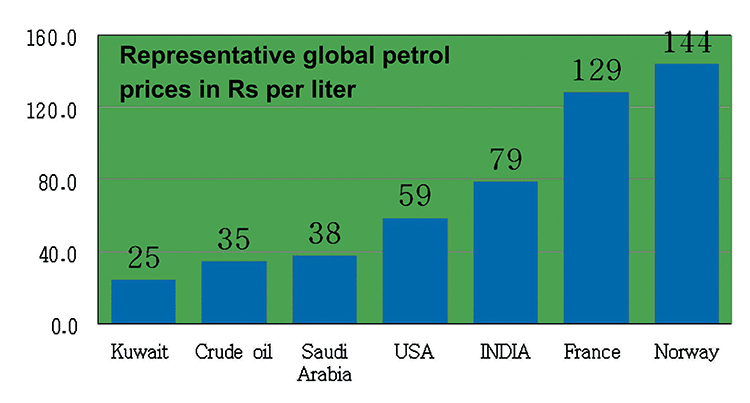

All over the world with the exception of oil exporting countries and that too where rulers are non-democratic, petrol and diesel are taxed heavily [See Chart on global petrol price]. There are about 55 countries where petrol is sold for above Rs.100 per litre with the highest being Rs. 153 per litre in Hong Kong. The petrol price Chart shows product cost is Rs. 39.21 per litre and total taxes are Rs. 37.09 per litre. Certainly taxes can be reduced. But it has to be followed by reducing subsidies and funding for welfare projects to control inflation. Or public sector oil companies can be forced to reduce price and incur losses as happened during the UPA rule.

No one likes paying taxes if they can avoid it. We know how a small percentage of India’s population pay income taxes. How can any government provide essential services (Defence, Police, Health, Education, Water supply, Power etc.,) and take up welfare projects if it does not have access to adequate funds?

Is common man really hurt by higher price? No

It is not the “common man” (another fake news) who is the loser as a result of higher petrol price as claimed by the political parties. Who is this common man? Who consumes petrol? It is mostly the owners of cars, SUVs and two-wheelers. When 30% of Indians are below the poverty line and roughly 20% are just about the poverty line who cannot afford cars and two-wheelers, is it really the common man suffering because of high petrol price? There is no free lunch. It is true that diesel prices will hurt farmers who use diesel pumps (only 12% of total diesel consumption in agriculture sector) and those that use public transportation. However, any such impact can be mitigated by Direct Benefit Transfer to poor farmers rather than lowering prices artificially.

Exporting petrol at half the price is fake news

Is Indian government truly exporting petrol at half the price to that of what we pay here and thus depriving the benefit to the common man? It is true export price is around Rs. 39 per litre and current price in Indian market (based on Delhi) is Rs. 79 per litre. While India can charge taxes on internal consumption, they cannot tax export prices. This is akin to comparing apples with oranges.

It is not Indian government which is forcing public or private companies to sell petrol to foreign countries. After meeting the domestic needs, oil companies make such decisions based on profitability. A private company like Reliance which has a very sophisticated refinery can buy the most inexpensive heavy and high sulphur crude oil (not many refineries in world have the capacity to process such crude oil) to maximise high valued petrol and diesel to export to profit for India. If, as implied by India Today statement, the government puts a ban on export of fuel products, it is India which stands to lose. Currently, India has a surplus of 11.6 million tons (MT) of petrol and 26.8 MT of diesel and India has to import 13.1 MT of LPG. If Indian refineries are prevented from exporting petrol, then they will be forced to import higher quantities of LPG which is a drain on Indian foreign exchange. In short, it is advantageous for India to export petrol and diesel.

Protest against rising fuel prices is a great political game

Unfortunately, protesting against any petrol price has become a “Great Game” to gain political capital by all political parties. While in Opposition, NDA also played the same game. Actually it is the consumer movement (which is yet to take off in India) that should have been in the forefront to demand competition amongst oil companies to bring down petrol prices (I hasten to add, not the kind of decrease political parties are demanding).

Today, it is the pricing umbrella based on import parity formula adapted by oil companies (that is product cost charged to petroleum dealers is based on hypothetical cost of importing petrol when in fact we are exporting it) has killed any competition in petroleum marketing. Why should petrol be sold at the same price at all stations in every city? It should be decided by the competition amongst the oil companies. Political parties should protest against such consumer-unfriendly practices, instead of reducing taxes which finally hurts the common man.

It is reasonable to have different opinions on the rate of taxes to be imposed (VAT in Maharashtra is around 42% while in Goa it is 17% and Karnataka it is 30%). But it should be debated not in the streets of India by organising Bharat Bandh but in the Parliament and State Assemblies.

Note: Dr. Bhamy V. Shenoy, an IITM graduate, has over 50 years of experience in international oil industry having worked for Conoco in the US, and Europe. He was on the Board of Georgian National Oil company, Advisor to former Soviet Union countries of Kazakhstan, Uzbekistan, Turkmenistan and Georgia and also advised Ghanian Government, Pemex in Mexico, Pertamina in Indonesia, etc. In India, he served as a member of Advisory Committee to Chairman of ONGC. He was Senior Advisor to Centre for Energy Economics at University of Texas.

It is good that the governments are getting revenues in the name of excise tax or consumption tax or use tax. Best way to get the money out of middle class and rich people, since no one wants to pay income tax. Indian government should abolish income tax which creates disposable money for anybody, which then be put into economy. They spend, and government can tax heavily on consumption of luxury items, and items used by rich people and upper middle class(like TVs, fridge, cars, luxury items, five star hotels, anything considered luxury). People who can afford buy and government get tax money. Don’t impose taxes on everyday items used by middle class and poor people. There won’t be any black money and all money will come into circulation.

Common man does not mean he should not own any car/scooter, it is a essential mode of travel for middle class people.