Budget gives big relief for tax-payers

New Delhi: In a clear move to woo

Goyal started his maiden Budget speech wishing Union Finance Minister Arun Jaitley a speedy recovery and good health. He presented the Budget in the absence of Jaitley, who is currently in the US for medical treatment. “I join the House in wishing Jaitley a speedy recovery, a healthy and long life in the service of the nation,” Goyal said.

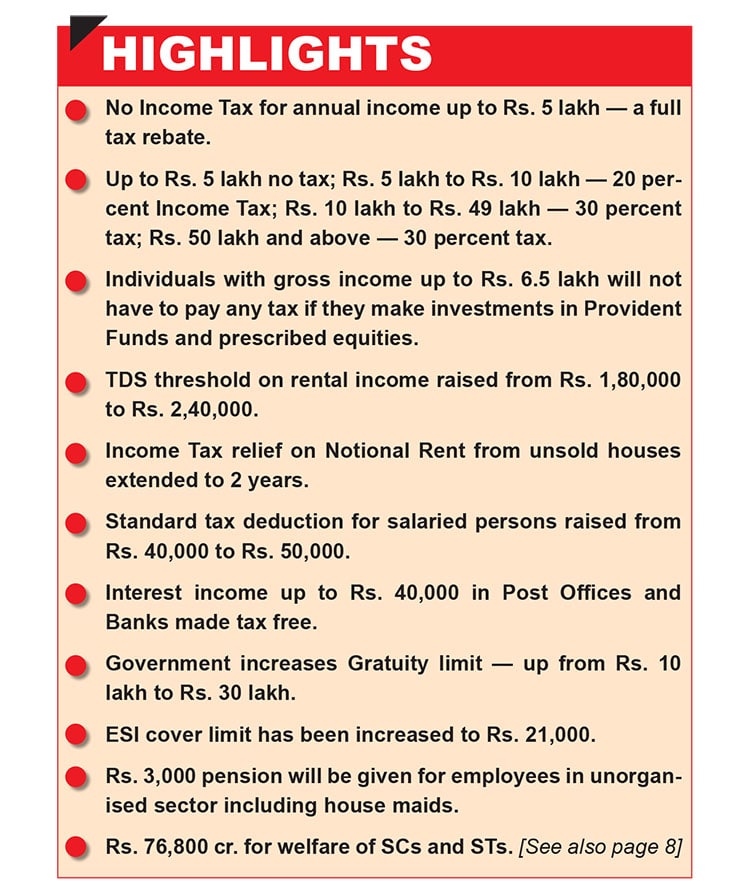

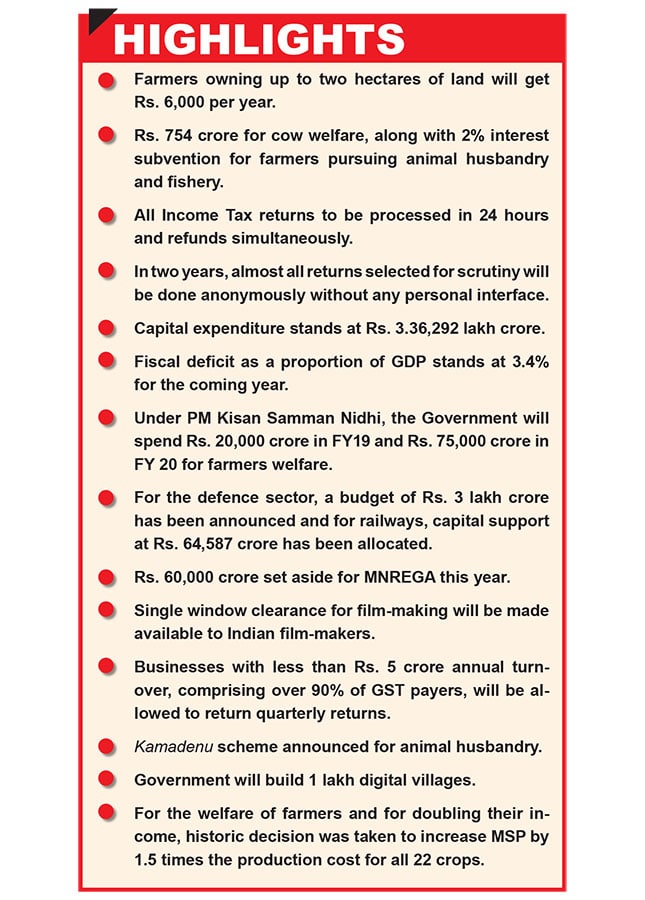

Unveiling the Interim Budget for 2019-20, he said the Income Tax rebate will benefit three crore people from middle class. After the new measure, those having an income of Rs. 6.5 lakh annually will not have to pay any income tax provided they make investments. This is the 5th and last Budget of Modi-led NDA Government. Goyal sought Parliament’s approval (vote on account) for incurring expenditure for three to four months until a new Government is installed after the Lok Sabha Elections.

The Finance Minister’s speech was shorter than usual and mainly concentrated on the achievements of the Government in the past five years.

Goyal unveiled ‘Vision 2030’ for 10 most important dimensions — physical and social infrastructure, digital India, clean and green India, clean rivers and safe drinking water, oceans and coastlines, expand rural industrialisation, space launch pad (placing an Indian astronaut in space by 2022), self-sufficiency in food, healthy India, minimum government and maximum governance.

He touched on woman-led empowerment and claims that 70% of beneficiaries of the PM Mudra Yojana are women. 26 weeks of maternity leave for working women and Pradhan Mantri Matritva Yojana are all empowering women.

Defence budget has been enhanced beyond Rs. 3 lakh crore and Goyal also announced substantial hike in military services pay. Govt has already disbursed Rs. 35,000 crore for soldiers under One Rank One Pension (OROP) scheme.

He said that the GST Council will take steps to reduce tax burden on home-buyers. Most daily-use items are now under 0-5% tax slab under GST, Goyal said.

GST exemption for small businesses has been raised to Rs. 40 lakh. The government also abolished duties on 36 consumer goods.

“We are committed to fighting black-money. Anti-black money measures taken by us in the last year have brought

Reacting to the Budget, Arun Jaitley said that it marks a high point in the policy directions that the Government headed by Prime Minister Narendra Modi has given to this nation.

“The Budget furthers the agenda of the government headed by PM Modi to comprehensively address the challenges of the economy. The Budget is unquestionably pro-growth, fiscally prudent, pro-farmer, and pro-poor and strengthens the purchasing power of the Indian middle class. Between 2014 and 19, every Budget has given significant relief to the middle class,” he said.

Recent Comments