- Digital rupee with blockchain from RBI coming up

- Taxpayers can file updated returns within 2 years in one-time window

- 30% tax for digital assets, highest tax band

- Rs. 2 per litre will be imposed on unblended fuel from Oct. 1, 2022

- All 1.5 lakh post offices to be connected to core banking system

- PM Gati Shakti Master Plan for expressways will be formulated

- National Highways network to be expanded by 25,000 km

What is cheaper?

Clothes, leather goods, agricultural equipment, mobile chargers, electronic equipment, steel, imported manufacturing machines, transformer equipment, diamond jewellery, gemstones, imitation jewellery

What is costly?

All imported items, umbrellas

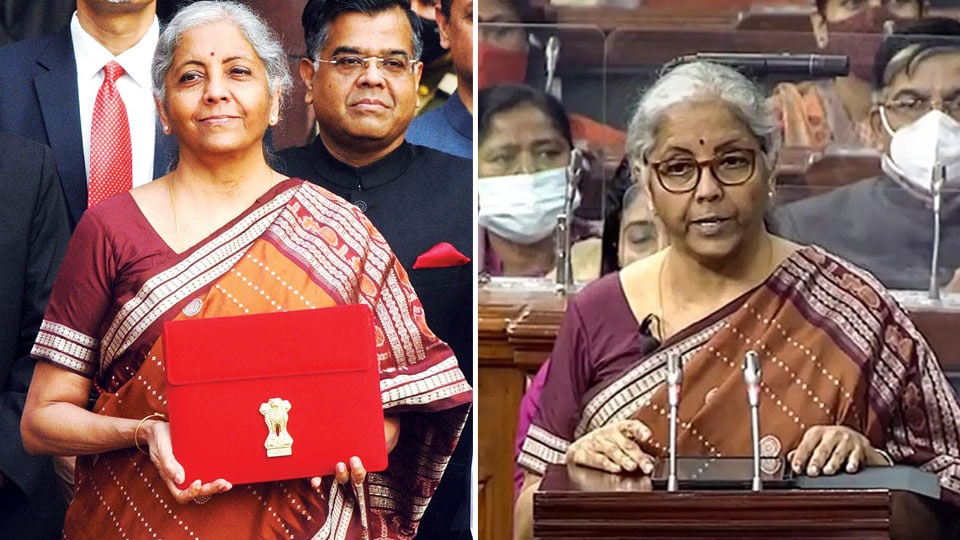

New Delhi: Finance Minister (FM) Nirmala Sitharaman this morning unveiled the Budget for fiscal year 2022-23 (her fourth Budget) with an aim to boost growth amid continued disruption from COVID-19 and rising inflation. This is the second consecutive year that a paperless budget was presented.

There has been no change in personal income tax slabs. In a relief to taxpayers, who face a tough time in getting the anomalies in their Income Tax Returns (ITRs) rectified, the Government will provide a one-time window to correct omissions in such returns. In her budget speech, the FM said that the updated returns will have to be filed within two years.

Income from transfer of any virtual digital asset shall be taxed at the rate of 30 percent. Besides, corporate surcharge has been reduced from 12 percent to 7 percent. While there is no change in I-T slabs, the Finance Minister announced tax relief for people with disabilities. Annuity and lump sum received to parents or guardians attaining 60 years during lifetime of the disabled person will be eligible for tax relief.

A digital-first approach took priority as the FM announced a proposal to launch Digital currency by the RBI, and setting up of a Digital University. “The introduction of central bank digital currency will give a big boost to the digital economy. Digital currency will also be a cheaper and more efficient currency management system,” Sitharaman said.

“It is therefore proposed to introduce digital rupee — using blockchain and other technologies — to be issued by the RBI, starting 2022-23,” she underlined. The move is seen as a big push for the Government’s “Digital India” programme.

It also comes amid deliberation over the regulation of cryptocurrency. The RBI had earlier voiced “serious concerns” around private cryptocurrencies on the grounds that these may cause financial instability.

Post office accounts

All 1.5 lakh post offices in India will be connected to the core banking system that will enable people to access their account online and also transfer money within post office accounts and to other banks. “In 2022, 100 percent of 1.5 lakh post offices will come on the core banking system enabling financial inclusion and access to accounts through net banking, mobile banking ATMs and also provide online transfer of funds between post office accounts and bank accounts,” Sitharaman said.

She added that this will be helpful especially for farmers and senior citizens in the rural areas enabling interoperability and financial inclusion. Currently, post offices provide savings account services and payments bank services through the India Post Payments Bank.

National Highway Network

PM Gati Shakti Master Plan for expressways will be formulated in 2022-23 to facilitate faster movement of people and goods. “The Master Plan will facilitate faster movement of people and goods and the National Highways network to be expanded by 25,000 km. Rs. 20,000 crore to be mobilised to complement public resources,” the FM said.

She said, “Budget lays parallel track of futuristic and inclusive blueprint for Amrit Kaal. Big public investment for modern infrastructure, readying India for 100 years of completion, will be guided by PM Gati Shakti.”

“PM Gati Shakti is driven by seven engines: roads, railways, airports, ports, mass transport, waterways, and logistics infrastructure. All 7 engines will pull forward the economy in unison Supported by energy transmission, IT communication, bulk water and sewerage and social infrastructure,” she said.

Though the Government has yet to confirm whether and how it will allow cryptocurrencies, sources for long have said that cryptocurrencies will be treated as a digital asset. The FM said that income from digital assets will be taxed at 30 percent, the highest tax band in the country.

After initially planning to ban cryptocurrencies, the Modi government is instead preparing legislation to regulate their use. Losses from transactions in virtual digital assets cannot be offset against other income, the FM said.

BUDGET HIGHLIGHTS-2022

- Taxpayers can now update I-T returns within 2 years

- Digital Rupee to be issued using blockchain & other technologies

- Customs duty on diamond to be reduced to 5 percent

- Income from Long Term Capital Gains will be taxed at 15 percent

- Corporate surcharge to be reduced from 12 percent to 7 percent

- Income from virtual digital assets to be taxed at 30 percent

- Spectrum auctions this year to enable 5G roll out by 2023

- Rs. 48,000 crore allocated for completion of construction of 80 lakh houses

- Tax deduction limit to be increased from 10 percent to 14 percent for Centre, State employees

- Rs. 1 lakh crore allocated to States to help investments

- Rs. 2.37 lakh crores will be the direct payment of MSP to farmers

- Additional allocation of Rs. 19,500 crore for manufacturing solar modules

- Capital expenditure to be around Rs. 10.68 lakh crore

- Special Economic Zones Act to be replaced soon

- 68 percent of the capital procurement budget for Defence to be earmarked for domestic industry Animation, gaming task force to be set up

- Production Linked Incentive Scheme to create 60 lakh new jobs in next 5 years

- Drones to be used for crop assessment, digitisation of land records, spraying of insecticides

- Will start issuing e-passports soon

- 400 new Vande Bharat trains to be manufactured in the next three years

- Emergency Credit Line Guarantee Scheme to be extended to March 2023

- Open platform for healthcare services to be rolled out soon

- PM Modi’s development initiatives for North East to be implemented

- Fund to be set up to finance agriculture, rural start-ups

- Gati Shakti master plan to make world-class infrastructure

Recent Comments