By B.N. Pramodh

In recent years, we have seen a lot of cases being reported for online bank fraud. According to NCRB (National Crime Records Bureau), there’s a decline in online bank fraud in India, with reported cases dropping from 160 crore in 2020-21 to 128 crore in 2021-22, but it is important to note that the CEN (Cyber Economic and Narcotics Crime) Police can take action only after a fraud has occurred, which is why it is crucial for individuals, especially senior citizens, to understand how these frauds take place and how to protect themselves.

Raising awareness is one of the most effective ways to combat online banking fraud. Banks and other organisations regularly remind individuals of the dangers of online banking fraud and the steps they should take to protect themselves through various mediums such as social media, television and newspapers. For example, they remind individuals that banks never ask for their username or password and that they should never share this information with anyone.

Furthermore, various Government and law enforcement agencies provide awareness and training programmes for citizens, where they are educated about the different types of online fraud, latest tactics and techniques fraudsters use, how to identify and avoid these types of scams and also about the legal and financial consequences of online frauds. They also educate individuals about the importance of keeping personal information private and secure and about the warning signs of online fraud.

Despite these efforts, fraudsters continue to find ways to entice individuals into falling prey to their scams. Here are some of the steps that fraudsters take to carry out online bank fraud:

1. Fraudsters obtain databases of bank account holders and credit card holders from the internet.

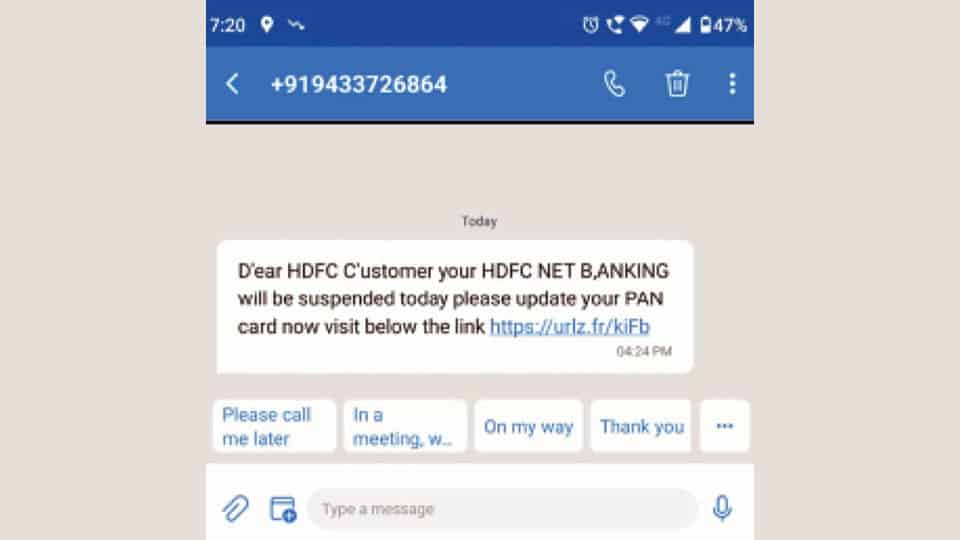

2. They then send SMS messages through various numbers. One should be alert when they receive an SMS from an unknown number about their bank account details. Usually, banks send their SMS with their names in the message and these messages are pre-approved by mobile phone service providers. However, fraudsters can use similar numbers to impersonate the bank. Also, SMS technology has evolved and block-chain technology is used to trace and track messages. If you get an SMS from a number about your bank account, delete the SMS immediately and do not click on any links.

You may also receive a call before or after the SMS is sent, stating that you have to update your bank details and a link has been sent, or your bank account will be frozen, closed, etc. Generally, this call will be in a threatening tone. Do not do anything. Just disconnect. Look at the SMS, if it appears discontinuous and words are split with ‘or,’ or ‘- .’ Get alert that it’s fake and delete.

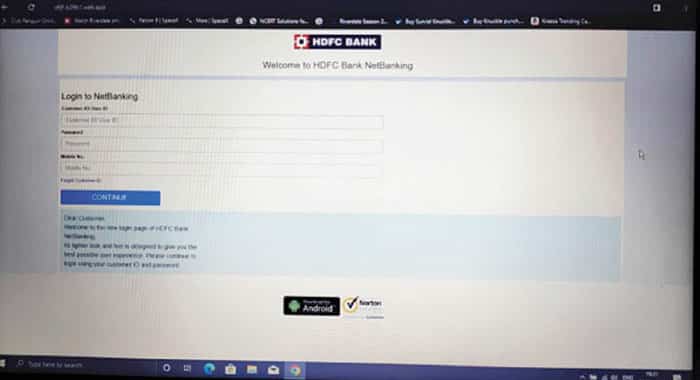

3. If by chance, you click on the link in the SMS, it will take you to a webpage similar to your bank’s website. There, they will ask for your customer ID, password and mobile number. If you find yourself on this fraudulent website, check the URL (Uniform Resource Locator) of the website. It will not belong to the bank and will usually be difficult to read. Many times, since this is opened in Google, the URL is not clearly seen, unless it is opened in a browser. This is also taken advantage of.

4. The fraudsters may also use SSL certificates (Secure Sockets Layer, a security protocol that creates an encrypted link between a web server and a web browser) to make the website look like it is safe for transactions. This is done to convince individuals that the website is legitimate.

These citizens, especially senior citizens, are often targeted by fraudsters for online banking fraud, as theymay be less familiar with technology and more trusting of unsolicited requests for personal information.

Here are some steps that senior citizens can take to protect themselves from online bank fraud:

Be cautious of unsolicited phone calls or e-mails: Fraudsters may try to trick senior citizens into revealing their personal information through unsolicited phone calls or e-mails. Always be cautious of unsolicited phone calls or e-mails, especially if they ask for personal information or financial details.

Never share personal information over the phone or e-mail: Senior citizens should never share personal information such as passwords, Aadhaar numbers or credit card numbers over the phone or e-mail. Banks and other legitimate organisations will never ask for this information over the phone or e-mail.

Use a secured computer and internet connection: Senior citizens should use a secured computer and internet connection when accessing online banking services. This means using a strong password, keeping anti-virus and anti-malware software up-to-date and being cautious of suspicious e-mails or pop-ups that may contain malware.

Use two-factor authentication: Many banks offer two-factor authentication for online banking transactions, which requires a second form of verification beyond a password. This can include a text message code or a fingerprint scanner. This provides an additional layer of security and makes it more difficult for fraudsters to gain access to an individual’s bank account.

Be aware of phishing scams: Phishing scams involve fraudsters tricking individuals into giving away their personal information by posing as a legitimate institution. Senior citizens should be aware of phishing scams and know how to identify them. They can do this by looking out for suspicious e-mails, messages and phone calls, being careful not to click on links or download attachments from unknown sources, and looking out for URLs that do not match the institution they claim to be.

Keep updated with the latest fraud trends and alerts: Senior citizens should keep themselves updated with the latest fraud trends and alerts so that they can identify the latest methods used by the scammers.

Seek help: If senior citizens suspect that they have been the victim of online bank fraud, they should seek help immediately. They should contact their bank, the Police and other relevant authorities as soon as possible to report the fraud and take steps to prevent further losses.

Educate yourself: Finally, senior citizens should educate themselves about online banking, technology and internet safety. This will help them to recognise potential threats and take necessary precautions to protect themselves from online bank fraud.

It is important to remember that the best defense against online bank fraud is to be vigilant and educated.

By following these steps, senior citizens can protect themselves from online bank fraud and enjoy the convenience and benefits of online banking.

[The author is a Startup mentor and a TiE (The Indus Entrepreneurs) Charter Member]

Western banks to save customer services, have outsourced them to India. Indians working in these customer services in India, routinely sell the details of bank accounts of Western customers, for $100 each. That should be the story here, about Indians who are never honest

Western banks to save customer services, have outsourced them to India. Indians working in these customer services in India, routinely sell the details of bank accounts of Western customers, for $100 each. That should be the story here, about Indians who are never honest