Mysuru: The public and private sector banks insisting on a minimum balance of Rs. 5,000 is causing concern for the common man whose salary could be a minimum of Rs. 10,000 or less.

The question that the ordinary man is asking is, how we can survive in these days of inflation and the rising costs of daily commodities, if banks demand that we keep Rs. 5,000 as minimum deposit. Is there no solution to this never-ending problem?

Just like in the past, the ever-reliable Post Office is coming to the rescue of the aam admi. All one needs to open a Post Office Savings Bank (POSB) account is Rs. 50, which will entitle you to a bank account and even an ATM card.

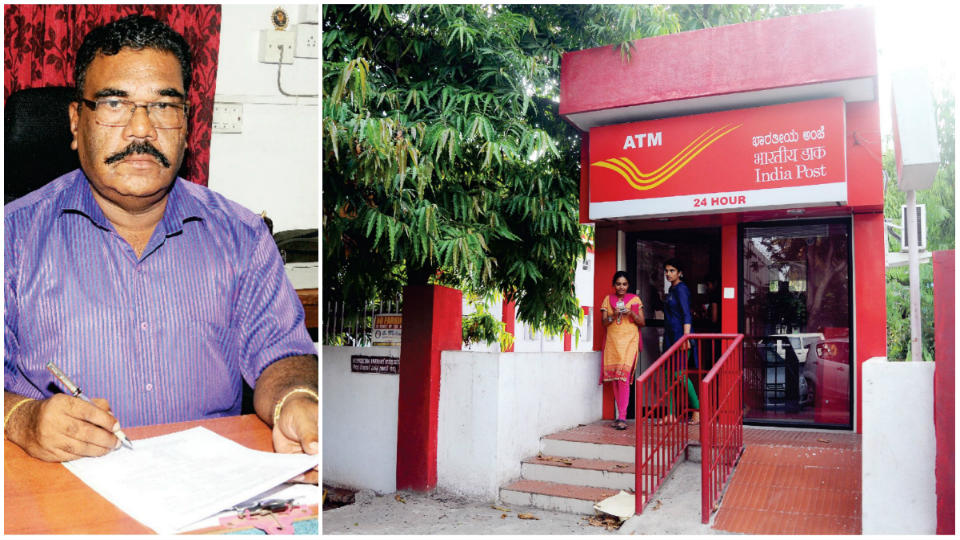

Speaking to Star of Mysore, Senior Superintendent of Post Office, Mysore Division, D. Shivaiah said that in the last one year 18,518 SB accounts have been opened in Mysore division and 4,350 ATM cards have been distributed. The account holders will get cheque facilities if they keep a minimum deposit of Rs. 500 only. Unlike in the past, the people who have accounts in other banks can withdraw money from Post Office ATMs, he added.

He stressed that unlike the banks where after five transactions Rs. 23 will be deducted as transaction charges, the Post Office will not deduct any amount and there is no limit on withdrawal of money. The interest rates the POSB is offering is also attractive when compared to the banks. The interest offered for senior citizens is 8.4 per cent for a five year fixed deposit which is very healthy when compared to the ones offered by public sector and private sector banks, he said.

In the current constrained scenario, if the common man shifts to Post Office Savings Bank, he would benefit far more than if he continues to bank with the public sector banks is the general feeling, said Shivaiah.

“We are ready for the challenge of more customers as we have always been customer-friendly,” said Shivaiah, signing off with a smile.

Think no more, move to the friendly Post Office for better service and better interest rate.

Recent Comments