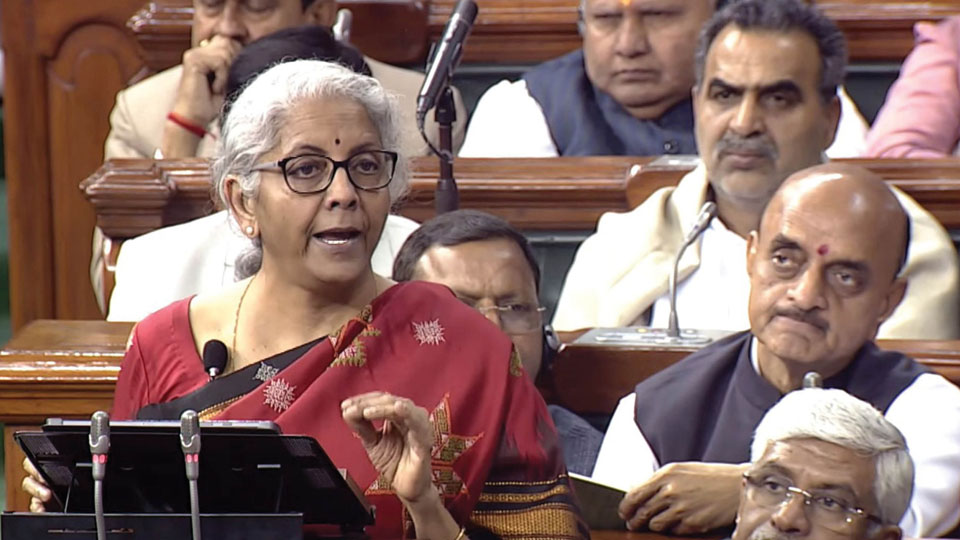

New Delhi: Union Finance Minister Nirmala Sitharaman today presented the last full-fledged Union Budget of the Modi Government before nine Assembly elections including Karnataka this year and the 2024 Lok Sabha elections.

The main highlight of the Budget is a new tax regime where the Income Tax rebate limit has been increased to Rs. 7 lakh from the existing Rs. 5 lakh. She added that the new tax regime will now be the default tax regime.

“I introduced in 2020, the new personal income tax regime with 6 income slabs, starting from Rs. 2.5 lakh. I propose to change the tax structure in this regime by reducing the number of slabs to 5 and increasing the tax exemption limit to Rs. 3 lakh,” she added.

More than an hour into the Budget 2023 speech, Nirmala Sitharaman did not touch up on any key banking sector reforms including the long held promise of privatisation of public sector banks.

The Budget Session of Parliament began yesterday and the first part will conclude on Feb. 13. The Parliament will reconvene on March 12 for the second part of the Budget Session that will conclude on April 6.

Sitharaman began her Budget speech by calling this the ‘first Budget of Amrit Kaal’ and a blueprint for India @ 100.

Nirmala Sitharaman said her Budget will have seven priorities, which she called the ‘Saptarishis’ guiding her outlook — inclusive development, digital infrastructure to aid agriculture sector, financial sector, infrastructure and investment, green growth, youth power and unleashing potential.

The Government has estimated the fiscal deficit for 2023-24 at 5.9 percent of the GDP. She said that the revised fiscal deficit is at 6.4 percent of the GDP. She added that India continued to be on the path of fiscal consolidation targeting to achieve 4.5 percent fiscal deficit of GDP by 2025-26.

“Our vision for ‘Amrit Kaal’ includes a technology-driven and knowledge-based economy, with strong public finances and a robust financial sector. To achieve this ‘janbhagidari’ through ‘sabka saath, sabka prayaas’ is essential.” The Government’s efforts since 2014 have ensured for all citizens a better quality of life. The per capita income has more than doubled to Rs. 1.97 lakh. “In the last 9 years, the Indian economy has increased in size from being 10th to 5th largest in the world. The world has also recognised India as a bright star, our growth for current year is estimated at 7.0 percent, this is the highest among all major economies, in spite of massive global slowdown caused by pandemic and the war,” she said.

During the COVID-19 pandemic, we ensured that nobody goes to bed hungry with a scheme to supply free foodgrains to over 80 crore persons for 28 months. We are implementing a scheme to supply foodgrains from Jan. 1, 2023, to all Antyodaya and priority households for the next one year, Nirmala Sitharaman said.

The Finance Minister said that 50 additional airports, heliports, water aerodromes and advanced landing zones will be revitalised.

‘Old political vehicles’: A faux pas brought laughter in the House when Sitharaman said old “political vehicles”, quickly correcting herself to say that “old polluting” vehicles, would be scrapped.

KEY TAKEAWAYS

- Capital investment outlay increased by 33 percent to Rs. 10 lakh crore – 3.3 percent of GDP.

- Highest-ever outlay of Rs. 2.40 lakh crore allocated for Railways.

- Credit facility for women entrepreneurs, banking reforms for senior citizens.

- Customs duty relief for certain inputs for camera lens & lithium batteries to continue for another year.

- 100 labs for developing apps using 5G services.

- Custom duty exemptions to be provided for the manufacturing of lithium-ion batteries.

- Basic custom duty rates to be reduced from 21 percent to 13 percent except for textile.

- Average processing time for Income Tax Returns reduced from 93 days to 16 days.

BUDGET HIGHLIGHTS

- Maximum deposit scheme for senior citizens – Rs. 15 lakh to Rs. 30 lakh.

- Relief for MSMEs: In cases of failure by MSMEs, 95 percent of forfeited amount will be returned to them by Government.

- Credit guarantee for MSME, revamped scheme will take effect from April 1, 2023 with infusion of Rs. 9,000 crore corpus. Cost of Credit to be reduced by 1 percent.

- Centre to support States to scrap old vehicles.

- Digital ecosystem for skilling to be further expanded.

- Centre will recruit 38,800 teachers and support staff for 740 Eklavya Model residential schools serving 3.5 lakh tribal students.

- All cities and towns will be enabled for 100 percent mechanical de-sludging of septic tanks and sewers to transition from manhole to machine hole mode.

- The outlay for Pradhan Mantri Awas Yojana is being enhanced by 66 percent to over Rs. 79,000 crore.

- 50 additional airports, heliports and advanced landings will be revived for improving air connectivity.

- Mission Karmayogi to provide learning opportunities for Government employees.

- For enhancing the ease of doing biz, more than 39,000 compliances have been used.

- To make AI work for India, 3 Centres for Excellence will be set up in top educational institutes.

- 95 percent of the forfeited amount will be returned to them by Govt. undertakings for contract failure during COVID.

- Rs. 10,000 crore per year to be invested on Urban Infra Development Fund.

- Settling contractual dispute: A voluntary settlement scheme will be used.

- Capital outlay of Rs. 2.4 lakh crore provided for Railways; highest-ever allocation since 2013-14.

- Rs. 35,000 crore for energy transition investment.

- Facilitating 1 crore farmers to adopt natural farming.

- To promote circular economy, 200 biogas plants will include an investment of Rs. 10,000 crore.

- Lab grown diamonds production to be encouraged via grant to an IIT.

- 100 labs for 5G apps to be set up in engineering institutes.

- 50-yr interest-free loan to State Governments extended.

- Scope of services in Digilocker to be expanded to help finance sector.

- PAN to be used as common identifier for all digital systems of specified Govt. agencies.

What Gets Cheaper

- Mobile phones & TV

- Lithium batteries

- Electric vehicles

- Lab-grown diamonds

What Gets Costlier

- Cigarettes & Clothes

- Imported rubber

- Gold and diamond

- Platinum and silver

NEW TAX SLAB

- No tax up to Rs. 7 lakh in the new tax scheme.

- 0-Rs. 3 lakh – Nil

- Rs. 3 lakh to Rs. 6 lakh – 5 percent

- Rs. 6 lakh to Rs. 9 lakh – 10 percent

- Rs. 9 lakh to Rs. 12 lakh – 15 percent

- Rs. 12 lakh to Rs. 15 lakh – 20 percent

- Above Rs. 15 lakh – 30 percent

What a load of non sense!

Boasting of Covid-19 in 2021, but her leader Narendra Modi grw a long beard and hid in a cave for 1 year not coming out, mean while, ordinary Indians did not get Oxygen supplies and died in hundreds of thousands with mass funeral pyres every where.

Most Indians do not touch the INR which is a waste paper, and want foreign currencies like the USD/Euro.

Third world crap.