Sir,

Thousands of commuters travelling by train from Mysuru to Bengaluru and nearby areas park their two-wheelers at the parking lot provided in City Railway Station premises. Incidentally, at Gate No.2 [CFTRI side] for all practical purpose is a two-wheeler parking lot.

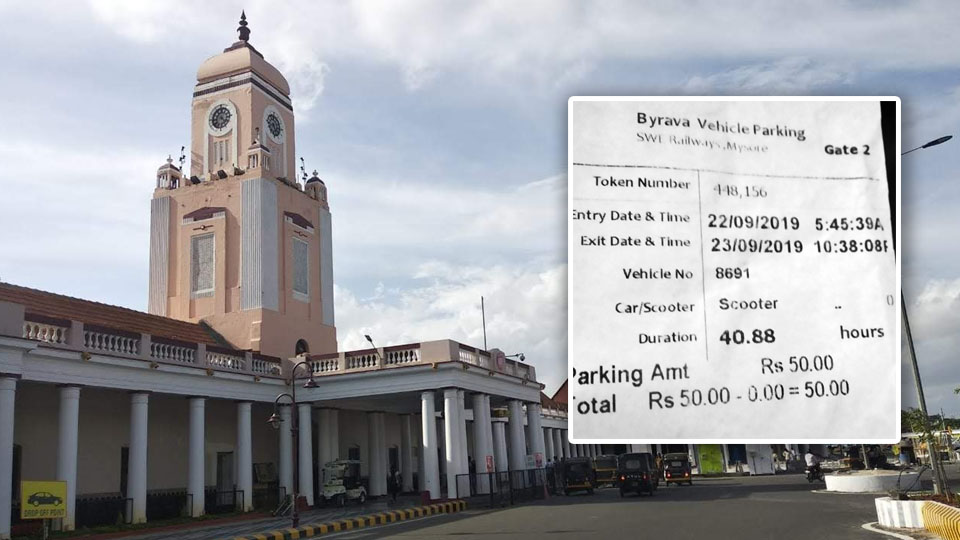

While checking into the parking lot, system-generated bar coded paper tokens will be issued indicating the vehicle number and checking in time particulars which shall be produced while checking out. But while checking out cash payment is being made by many users without insisting for system-generated payment receipts which the operator can generate by scanning the barcode token in no time.

Users paying the parking fees in cash may not be aware that failure to insist system-generated cash payment receipts may offer fertile ground and scope for large scale seepage of legitimate revenue to the exchequer.

At the first instance, parking fees for lesser period may be accounted by the operator despite collecting the fees for the whole day of parking which is normally the case and in good number of cases for two days and then annual gross revenue may be suppressed to come out of GST net itself as exemptions are available for GST compliance where the gross turnover is less than Rs.1.50 crore at present.

As a case point, based on system-generated cash receipt collected by me which was issued only on my demand (receipt No.448156 dated 22.9.2019), anybody can safely presume the gross annual collection for parking 9 lakh vehicles at an average rate of Rs.25 works out to Rs.2.25 lakh [numbering based on half-yearly parking of vehicles at 4.50 lakh] and inclusive of collection at Gate No.1 gross collection would be Rs. 4.50 crore per year and hold your breath, all in cash. With due respect to the operator, one can easily imagine the scope for seepage of GST and the Income Tax on net income, if the income is generated on the presumed line and in the absence of improper accounting of revenues.

It is time for the vehicle parking lot users not only at the Railway Station but also in public places where such facility is provided to demand for system-generated payment receipts which can be generated by the operator in a fraction of a minute by scanning the barcode of the entry token. Let the parking lot users join in nation-building exercise indirectly helping to mop up the revenue for the Government.

It is high time for installing point of sales [POS] machines to facilitate electronic payment mode. The lesser of the parking, the Railways shall give immediate instruction to the contractor for installing the POS machine.

– V.K. Ramachandra, Srirampura, 16.11.2019

You can also mail us your views, opinions, and stories to [email protected]

Recent Comments