The midnight of June 30 – July 1, 2017 was historic for India that is Bharat as the political parties, except for one or two, came together to witnesses the launch of Goods and Services Tax (GST) at the magnificent Central Hall of the Parliament. This Weekend Star Supplement brings to you the basic information on GST and most importantly, its effect on common man.

India rolls out Goods and Services Tax [GST]

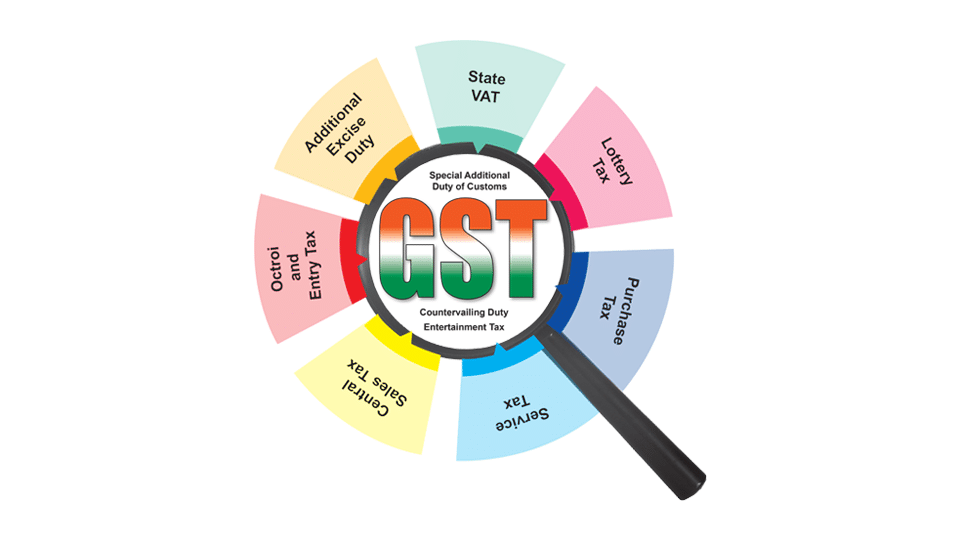

Goods and Services Tax (GST), considered to be a historic tax reform, has come into effect from today (July 1). GST is expected to completely transform the Indirect Taxation landscape in the country involving both the Central and State levies. In a departure from the normal practice, GST will be administered together by the Centre and States.

To commemorate the historic occasion, a function was organised at the Central Hall of Parliament on yesterday mid-night to roll out the GST. President Pranab Mukherjee, Vice President Hamid Ansari, Prime Minister Narendra Modi, Former Prime Minister H.D. Deve Gowda, Speaker Sumithra Mahajan, industrialist Ratan Tata, RBI Governor Urjit Patel, Union Cabinet Ministers, Chief Ministers of various States and others were present.

Why is GST so important?

GST will pave the way for realisation of the goal of One Nation – One Tax – One Market. GST will benefit all the stakeholders namely industry, government and consumer. It will lower the cost of goods and services, give a boost to the economy and make the products and services globally competitive, giving a major boost to ‘Make in India’ initiative.

Under the GST regime, exports will be zero-rated in entirety unlike the present system where refund of some of the taxes does not take place due to fragmented nature of indirect taxes between the Centre and the States. GST will make India a common market with common tax rates and procedures and remove economic barriers. GST is largely technology driven and will reduce the human interface to a great extent. GST is expected to improve ease of doing business in India.

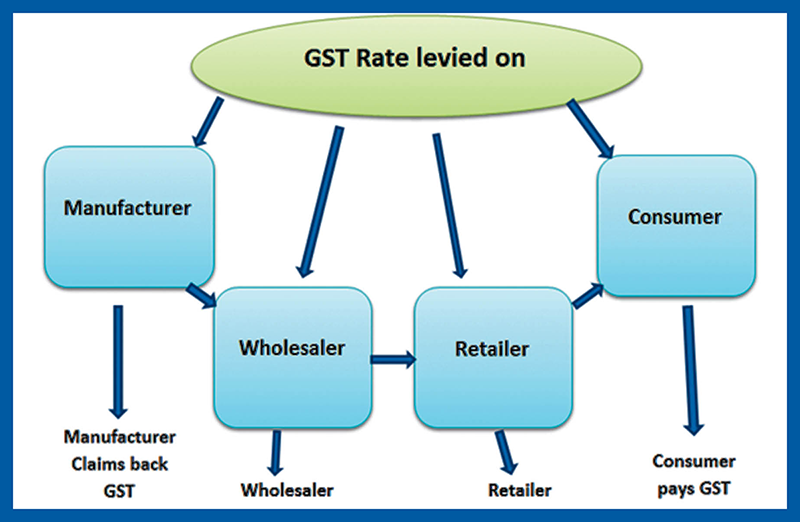

In majority supply of goods, the tax incidence approved by the GST Council is much lower than the present combined indirect tax rates levied [on account of central excise duty rates/embedded central excise duty rates/service tax post-clearance embedding, VAT rates or weighted average VAT rates, cascading of VAT over excise duty and tax incidence on account of CST, Octroi, Entry Tax, etc.] by the Centre and States.

On Mar. 29, Finance Minister Arun Jaitely tabled four Goods and Services Tax (GST) Bills for consideration and passage in the Lok Sabha namely The Central Goods and Services Tax (CGST) Bill, 2017, The Integrated Goods and Services Tax (IGST) Bill, 2017, The Union Territories Goods and Services Tax (UTGST) Bill, 2017 and the GST (Compensation to States) Bill, 2017. They were passed by the Lok Sabha on Mar. 29 and by the Rajya Sabha on Apr. 6

Final structure of GST

The threshold limit for exemption from levy of GST is Rs. 20 lakh for the States except for the Special Category, where it is Rs. 10 Lakh.

A four slab tax rate structure of 5%, 12%, 18% and 28% has been adopted for GST.

A cess would be levied on certain goods such as luxury cars, aerated drinks, pan masala and tobacco products, over and above the GST rate of 28% for payment of compensation to the states.

The threshold for availing the Composition scheme is Rs. 75 lakh except for special category States where it is Rs. 50 lakh and they are required to file quarterly returns only. Certain categories of manufacturers, service providers (except restaurants) are out of the Composition Scheme.

Important features of GST

GST envisages all transactions and processes to be done only through electronic mode, to achieve non-intrusive administration. This will minimise tax payers physical interaction with the tax officials.

GST provides for the facility of auto-populated monthly returns and annual return.

It also facilitates the taxpayers by prescribing grant of refund within 60 days, and provisional release of 90% refund to exporters within 7 days. Further facilitation measures include interest payment if refund is not sanctioned in time, and refund to be directly credited to bank accounts.

Comprehensive transitional provisions for ensuring smooth transition of existing taxpayers to GST regime, credit for available stocks, etc.

Other provisions include system of GST Compliance Rating, etc.

Anti-profiteering provisions for protection of consumer rights.

What is SGST / CGST / IGST?

The GST to be levied by the Centre on intra-State supply of goods and/or services is Central GST (CGST) and that by the States is State GST (SGST).

On inter-state supply of goods and services, Integrated GST (IGST) will be collected by Centre. IGST will also apply on imports.

GST is a consumption-based tax, that is, the tax should be received by the State in which the goods or services are consumed and not by the State in which such goods are manufactured. IGST is designed to ensure seamless flow of input tax credit from one State to another. One state has to deal only with the Central Government to settle the tax amounts and not with every other State, thus making the process easier.

Example: A dealer in Karnataka sells goods to the consumer in within the State worth Rs. 10,000.

The GST rate is 18% comprising of CGST rate of 9% and SGST rate of 9%, in such case the dealer collects Rs. 1800 and Rs. 900 will go to the Central Government and Rs. 900 will go to the Karnataka Government.

Now, if the dealer in Karnataka had sell goods to a dealer in Gujarat worth Rs. 1,00,000. The GST rate is 18% comprising of CGST rate of 9% and SGST rate of 9%. In such case the dealer has to charge Rs. 18,000 as IGST. This IGST will go to the Centre.

What gets Costlier?

Gold, ghee, biscuits, chewing gum, branded flour, branded rice, ice cream, chocolates, ayurvedic medicines, hotels with room tariffs above Rs. 5,000, restaurants in five-star hotels, AC restaurants, movie tickets costing more than Rs. 100, music concerts, IPL match tickets, perfumes, AC train tickets, business-class air tickets, air-conditioner, refrigerator, washing machine, television, LED TV, mobile phone bills, insurance premiums, banking charges, credit card charges, motorcycles with engine capacity of more than 350 cc, soft drinks.

What gets Cheaper?

Tea, edible oils, sugar, textiles, baby formula, milk, rice, wheat, pasta, spaghetti, macaroni, noodles, pickle, ketchup, sauces, mineral water, cashew nuts, soap, hair oil, detergent powder, toothpaste, agarbathies, notebooks, printers, pens, insulin, spectacles, footwear, khadi fabrics, silk, electric transformers, movie tickets less than Rs. 100, luxury cars, motorcycles, economy-class air tickets, hotels with lower tariff, cement.

Recent Comments