By Vikram Muthanna

Like most Indians I too watch the Union budget. But usually by the end of the Finance Minister’s speech I feel like I have understood nothing and end up feeling like I have a learning disability. Finally my perception of a budget is reduced to — “what has gotten costlier and what has gotten cheaper.”

But for the past three years I have been making an effort to have a better understanding of the budget and this time more so, for two reasons. The first reason is Dr. Subramanian Swamy.

On June 16, 2016 at an event in Mumbai, Dr. Swamy had said, “If I am in the Government, I will do it within one week, if I am not in Government I will do it within three years.” He was talking about abolishing Income Tax! Well, it’s been three years and Income Tax remains. Even Dr. Swamy could not disprove the old adage: Two things are guaranteed in life — Death and Taxes.

But are more Indians paying taxes? Not yet. Since 2014 the tax base has increased from 3.31 crore to 6.85 crore but of this nearly two crore individuals who filed I-T returns paid zero tax ! Obviously people are still evading taxes.

In fact, according to a news report in Economic Times based on the I-T Department’s report on last year’s tax numbers, it seems of the 8.6 lakh doctors in the country, less than half of them paid Income Tax.

In the whole country just 13,000 nursing homes and clinics paid tax, that’s less than fashion designers! Nearly 14,500 fashion designers paid their taxes last fiscal. Even more interesting, just one in three Chartered Accountants in India paid Income Tax!

That is why it is argued that since India’s growth is fuelled by consumption unlike an export-oriented nation like China, abolish the Income Tax and make up that money by increasing indirect taxes. And since people will have more disposable income they will consume more.

But this increase in consumption will increase cost also, which will hurt the poor and increase the wealth gap. So Income Tax will stay. Also Income Tax adds 20% to the Government’s kitty which helps pay for the welfare schemes.

Now, some grudge welfare schemes as “freebies” but it is important to do this for a nation’s overall well-being. LPG, piped water, toilets, house, insurance and pension are schemes that bridge the gap between the “haves” and “have-nots.” It creates equality at least in basic services.

The problem, of course, is when Government does not help the tax-payers to grow so they can pay more taxes and create more jobs. Even worse, when it over-taxes the golden goose.

This brings me to the second reason I was watching this budget closely — Inheritance Tax.

Rumours were rife before this budget that the Government was planning on bringing back the abolished Inheritance Tax with a tax rate of 10% of the property’s value! Which means if I have to inherit property or money in the bank I would have to work hard and get rich to pay the tax on it to possess it! I had planned to say “no thank you” to my inheritance, but since that tax never came, I still hope to receive the fruits of someone else’s hard work. Ah! Just like our Government.

Yes, our Government is not a fair partner. Why do we pay the Government? Because it provides infrastructure, protection and other services for your business to thrive. But does it? In fact in most cases Government’s apathy and corruption is the reason businesses fail. That is why Gurucharan Das, the retired Head of Procter & Gamble said: “In my thirty years of active business in India, I did not meet a single bureaucrat who really understood my business, yet he had the power to ruin it.” And Government needs to fix this issue before taking a cut from corporate profits. Guess the forced retirement of Officers with chequered background recently is an attempt in that direction.

But more importantly while the Government has seen the political benefit in welfare schemes, it should build such schemes while creating more tax-payers and not by taxing existing tax-payers more. Rich Indians today are paying more taxes than rich Americans! The Indian rich pay 42.7% tax, the Americans pay 40%.

Guess in the end a budget should be as Kautilya said, “A King’s tax policy should resemble a bee’s extraction of nectar from a flower: no enterprise should be taxed more than once; then it can flourish, profit and so can be taxed again another day.”

The Congress Party tasted political success with welfare schemes and they did it by robbing Peter to pay Paul and Paul kept voting for them. But today poor Paul has become aspirational, he wants an environment where he can fish for himself and catch as much fish as he wants, he simply doesn’t want to be given a free fish. That is why education and industry should be in sync and this budget has failed in the former.

For now, I declare this a healthy budget. Why? Well, Petrol is expensive so soon we’ll have to cycle to work. Not only is it good exercise but also decreases pollution. To add, cigarettes are even more expensive, so no more smoking, good for your health and wallet.

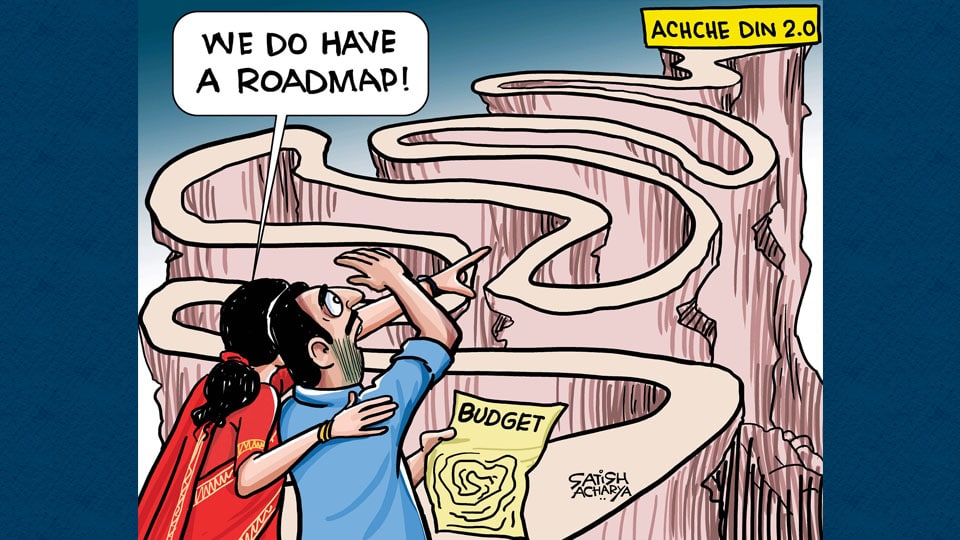

P.S.: When I heard Nirmala Sitharaman quote Lord Basaveshwara a couple of times yesterday I was surprised. And this morning 15 MLAs have resigned in the State Coalition. Was Sitharaman trying to appease the Lingayats, the dominant vote-bank in Karnataka? Is Karnataka headed for a mid-term poll? Guess, this budget had more than just numbers on its mind, it had politics too !

e-mail: [email protected]

Set the top income tax rate to those earning their income through non-business means- that should include the professionals.Then Then assume a percentage of 60% flat rate tax for the money changing hands as income at the source in income-related transactions, and that money-changing should be mandated not in cash, but only through cheques involving bank accounts. Then,it should be left to individuals to submit the evidence of their income ,if it does not deserve the 60% rate of income tax, to claim back the refund. All cash transactions above Rs1000 for example, should be mandated through cheques.

A visitor from a Western country,in the case of a he,braving stray digs, polluted drinking water, aggressive beggars, and fleecing merchants including hotels etc.., or a she braving rape and molestation,visits this country,he/she will be flabbergasted to see almost all transactions made through cash: doctors bills paid through a large wad of Rupees bills for example. In many instances,a professional like an account or a doctor rendering services , demand US Dollars for the settling the bills. It is a common practice for customs officers in the Airports demanding US Dollars for waving off the mounds of luggage brought in by the visitor without inspection. The Indians do not have faith in their own currency, and they know when it comes to themselves making a trip abroad or send their children out to study in a Western country,having US Dollars helps. These professionals and indeed many businessmen amass mounds of cash in Rupee bills , hidden, so that they can pay a NRI resident in the West , an inflated rate of exchange in Rupees for the NRI relatives in India, if they themselves have to make trips to the West or send their children out to study in the West. Paying income tax does not help these ventures.

Indian banks are nationalised, and forcing cashless transactions above a maximum sum, as suggested by the poster above does help. In the West every one who has income has to file income tax returns,even after the percentage rate of tax on income is deducted at the source for professionals. Free-lancing professionals have to file tax returns. The tax evasion gets o be minimal. Of course,no scheme is perfect,but yet the government gets tax dollars into its exchequer to provide for public services.

Having said the above, India is known for institutional corruption, be it political,administrative or societal kind-the outcome of its independence status since 1947. Income tax officials could be wished away,through greasing of their palms, preferably with US Dollars!

The claim made in that budget, by the Finance Minister that Indian economy is ranked 6th in the world,based on paper figures, sounds and looks spurious,if one looks at the level of poverty with tens of millions of Indians condemned to gnawing poverty and severe lack of clean drinking water and abysmal state of public health.

I would not watch the budget presentation which is a charade. I would despair at the current state of this once fine country.