Sir,

The property tax collection by MCC has not been planned properly and there is no coordination between the Corporation and the bankers who receive the amounts at the counters.

By avoiding online acceptance for one more year with lame excuses of COVID-19, the MCC continues to inconvenience the tax-payers by making them wait for the current year’s tax SAS statement and later to stand in long queues to pay the tax at the Bank counters.

Based on the previous years’ experience, they could have properly assessed the number of people who come for paying the taxes to avail rebate and make arrangements at all stages, like speeding up of the issuing of current year’s SAS statement in just one or two days, to ask the bankers to provide sufficient number of cash counters to avoid the rush. Also more nationalised bank branches should be authorised to collect the amounts.

Without bothering about the difficulties of the public, most of them senior citizens, the MCC has gone ahead with the tax collection work, which looks to be shabby and reflects the poor show of the civic administration.

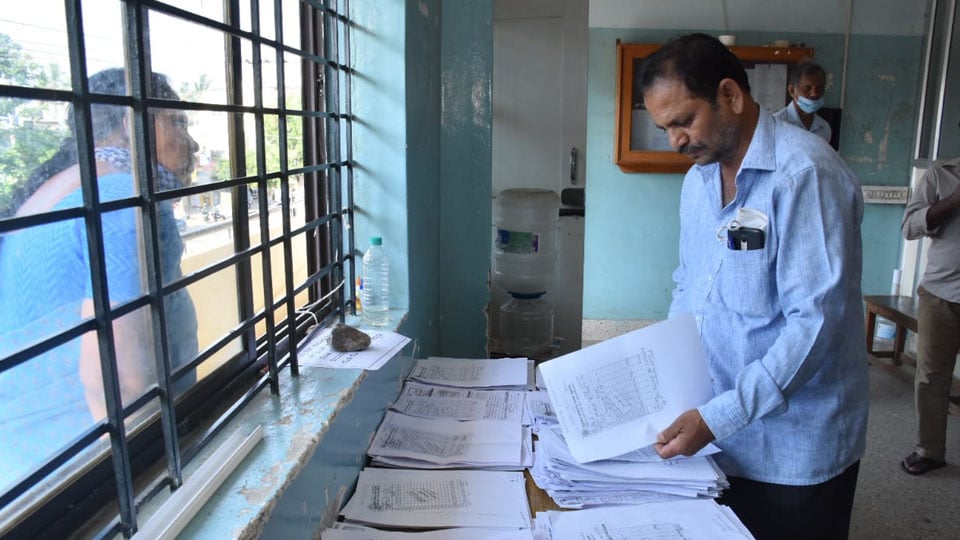

To avoid rush at MCC Office, the Residents Association of SBM Colony, Srirampura, took the initiative to collect the SAS of previous year of about 70 residents and got the computerised current SAS statements and wherever there were discrepancies of tax amount compared to previous year, were verified and scrutinised by the Revenue officials concerned. And finally when these 70 cheques collected for each SAS statement were submitted to the lone cash counter, the cashier at the counter refused to accept the 70 cheques amounting to Rs.3.50 lakh as it would involve more time and asked the individual member to stand in queue and get their work done.

This was brought to the notice of Zonal Assistant Commissioner and others who assured to look into matter but are yet to receive the cheques. The concerned banks should be asked to provide more cash counters to ease the situation. They may also facilitate payment of taxes at their other Bank branches also to avoid queues.

As regards the discrepancies in the current year’s SAS computerised statement, lot of complaints from the residents were raised against huge enhancements with serious discrepancies like, i) though there was no I floor of a house, tax has been calculated for the first floor also and added, ii) though the house has teakwood doors for front and puja rooms only, rates for all teakwood doors for the whole house is calculated, iii) though the house has granite floor only on ground and glazed tiles for the I floor, rates of granite for both floors has been noted etc.

The MCC is requested to review the current year’s data and wherever such discrepancies are pointed out by the residents, should be scrutinised and rectified accordingly before accepting the amounts, as the computerised data would be the permanent basis on which tax calculations would be made for future also.

On the whole, the MCC Commissioner is requested to review the serious situation and streamline the procedure to allow more people to remit taxes. If not done immediately, the tax- payers would not mind the 5% rebate which involves above problems, and would prefer to pay at any other time during the year before next March without much difficulty, by which the MCC will be the loser.

– K.V. Ramanath, Secretary,, Mysore Bank Colony Residents’ Cultural & Welfare Association, Srirampura II Stage, 28.5.2020

You can also mail us your views, opinions, and stories to [email protected]

Recent Comments