New Delhi: With an aim to boost the UPI (United Payments Interface) platform and digital payments, the Reserve Bank of India (RBI) on Wednesday allowed the linking of credit cards to the UPI platform.

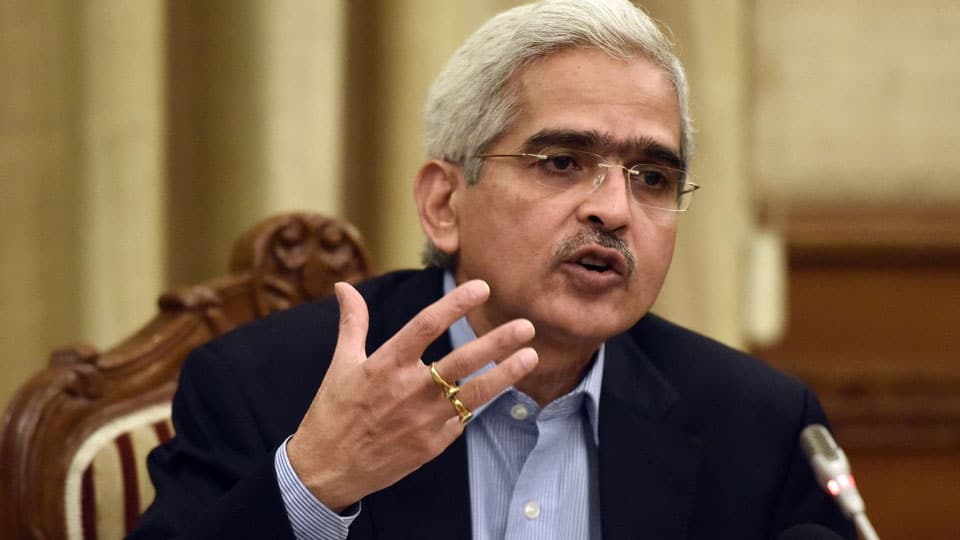

It will begin with the Rupay credit cards, as they will be linked to the UPI platform. “This will provide additional convenience to users and enhance the scope of digital payments,” RBI Governor Shaktikanta Das said.

UPI has become the most inclusive mode of payment in the country with over 26 crore users and 5 crore merchants on the platform. In May 2022, about 594 crore transactions amounting to Rs. 10.4 lakh crore were processed through UPI.

At present, UPI facilitates transactions by linking savings or current accounts through users’ debit cards. With this new proposal, users can link their credit cards with UPI. Two out of five transactions that are happening now are non-cash and a recent report by digital payments company PhonePe and Boston Consulting Group said that by 2026, two-thirds of payment transactions will be digital.

Also, UPI transactions are at approximately nine times more than credit and debit card transactions in volume terms in FY22.

Recent Comments