Mumbai: The Reserve Bank of India (RBI) said yesterday that 88 percent of the country’s highest denomination 2,000-rupee currency notes — worth 3.14 trillion rupees — have been returned since its decision to withdraw them from circulation. The RBI said in May 2023 that it would withdraw these high-value notes, permitting their exchange or deposit…

Depositing Rs. 2,000 currency notes at Banks begins

May 23, 2023Mysore/Mysuru: The process of depositing currency notes in the denomination of Rs. 2,000 began at various Banks in the city this morning. This follows the decision of Reserve Bank of India (RBI) on May 18, 2023, withdrawing the circulation of Rs. 2,000 currency notes, but continuing to be legal tender, with the time provided till…

RBI withdraws Rs. 2,000 notes from circulation

May 20, 2023Asks all to exchange or deposit them by Sept. 30 New Delhi: The Reserve Bank of India (RBI) made an announcement last evening regarding the withdrawal of Rs. 2,000 note, the highest value currency note in circulation. However, the RBI clarified that these notes would still be considered legal tender. Existing Rs. 2,000 notes can…

RBI allows credit cards to be linked with UPI platform

June 8, 2022New Delhi: With an aim to boost the UPI (United Payments Interface) platform and digital payments, the Reserve Bank of India (RBI) on Wednesday allowed the linking of credit cards to the UPI platform. It will begin with the Rupay credit cards, as they will be linked to the UPI platform. “This will provide additional…

No plans to replace face of Mahatma Gandhi on bank notes, clarifies RBI

June 7, 2022New Delhi: The Reserve Bank of India (RBI) on Monday said that there is no proposal to change existing currency and bank notes by replacing the face of Mahatma Gandhi with that of others. It denied reports which claimed that RBI was considering changes to the existing currency and bank notes. “There are reports in…

Soon, currency notes may have watermarks of Tagore and Kalam

June 6, 2022New Delhi: The Finance Ministry and the Reserve Bank of India (RBI) are reportedly considering using the watermark figures of Rabindranath Tagore and Dr. APJ Abdul Kalam on a new series of bank notes of some denominations. At present, the denominations of the notes that we use are of Mahatma Gandhi, the father of the…

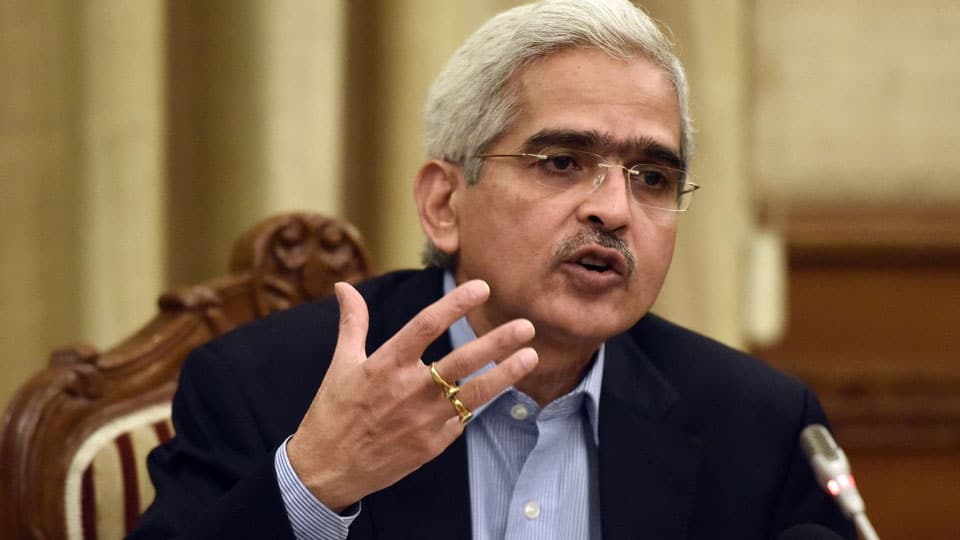

‘Make in India’ initiative: RBI Governor opens Bank Note Ink Unit in Mysuru

March 30, 2022Lays foundation stone for Learning and Development Centre Mysore/Mysuru: Reserve Bank of India (RBI) Governor Shaktikanta Das was on a visit to Mysuru on Mar. 28 where he dedicated ‘Varnika,’ the Ink Manufacturing Unit of Bharatiya Reserve Bank Note Mudran Private Limited (BRBNMPL), to the nation. BRBNMPL has set up ‘Varnika’ with an annual ink…

ATM cash withdrawal charges to increase from Jan. 1, 2022

December 4, 2021Five free transactions a month; later Rs. 21 will be deducted per transaction New Delhi: According to the latest announcement by Reserve Bank of India (RBI), the cash withdrawal charges on ATMs will be slightly heavier on the pockets of users if they surpass the monthly limit of free transactions on their debit or credit…

RBI changes rules for Fixed Deposits: Claim your money as soon as FD matures lest you face a loss

July 5, 2021New Delhi: The Reserve Bank of India (RBI) has changed the rules for Fixed Deposits (FD) as it said that if a customer has not claimed FD even after maturity, then he/she will have to bear the loss in terms of interest in savings. The bank further stated that customers can still earn interest after…

Auto debit facilities to stay; new RBI rule put off till Sept. 30

April 1, 2021New Delhi: In a reprieve for banks and millions of customers, auto debit facilities for payment of bills and subscriptions will stay in place for six more months. The Reserve Bank of India (RBI) has extended the deadline for a rule that would have caused disruptions from Apr. 1 (today). Recurring transactions will continue till…

Recent Comments