Properties like Kuvempu’s house ‘Udaya Ravi’ in V.V. Mohalla is taxed for setback areas. Ironically, this house was constructed 74 to 75 years back with the then construction practices and rules.

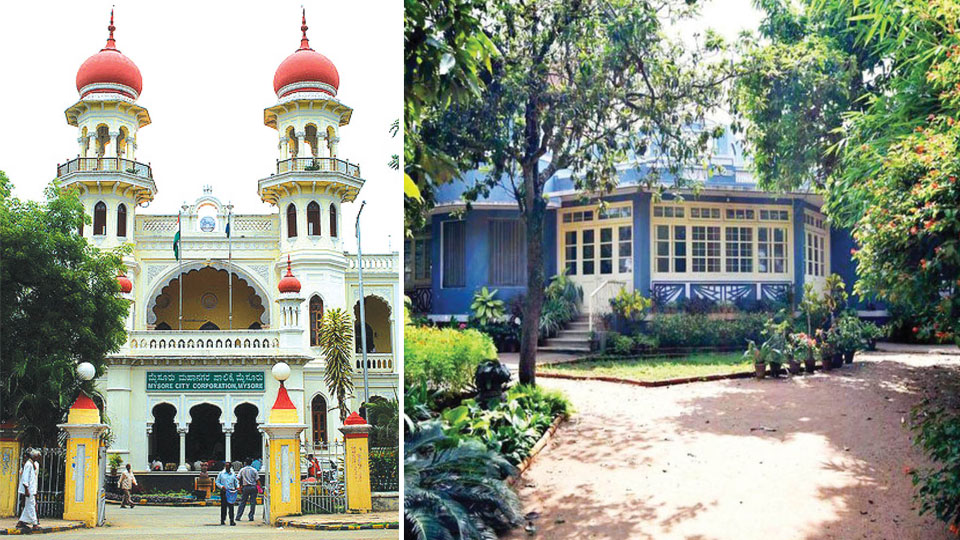

Mysore/Mysuru: The present system of Property Tax levied by the Mysuru City Corporation (MCC) is flawed and immediate remedial measures have to be taken to streamline the tax system into a fool-proof one for the convenience of the public, said the city-based NGO Mysore Grahakara Parishat (MGP).

In a statement to the media, the MGP has stated that the Property Tax system implemented for the current year must be reviewed entirely keeping in view the shortcomings of the system.

Buttressing its arguments with certain facts and point of arguments, the MGP has stated that in the current assessment of Property Tax, it is observed that the MCC has not followed the prescribed parameters while enhancing the taxes. Some of them are as follows:

1. Uniform Tax rates are not being followed while assessing the tax component for residential houses and apartments.

2. From 2008 onwards up to 2020-21 Property Tax demand was computed on 2008-09 guidance value issued by the Inspector General of Stamps and Registrations, Bengaluru, at rates of 0.6 percent to 0.9131 percent at 15 percent hike in each block period of three years. 50 percent of the Guidance Value was considered for assessment of Capital Value as per Section 45B of Karnataka Municipality Act of 1976.

3. For 2021-22, tax-payers noticed that Guidance Value has changed to a large extent from over Rs. 1,000 to Rs. 1,300 to Rs. 3,000 to Rs. 4,200 per sq.ft. in different roads of each Mohalla or Zone or Ward.

4. Karnataka Gazette Notification about the review of Guidance Value and the date of effect is not made available to the tax-payers, in the absence of which the public are not aware of the parameters under which the enhancement is made.

5. Date of resolution of the MCC Council on the above revised Guidance Value and introduction of new taxes is not notified to the public.

6. Copies of the detailed guidelines about application on new Guidance Value and assessment for educating the public should be made available at all the Zonal Offices.

7. Land appurtenant to the house is taxed. Capital Value of houses on independent plots is assessed on the following terms:

a) Area occupied by the plinth with guidance value of the locality

b) Built up plinth area in each floor at guidance value for type of construction per sq.ft.

c) Land appurtenant of the plinth area in excess of 1,000 sq.ft.

Heritage properties like Kuvempu’s house ‘Udaya Ravi’ in V.V. Mohalla is taxed for setback areas. Ironically, this house was constructed 74 to 75 years back with the then construction practices and rules.

Hitherto three times the plinth area was permitted as open area around the house to promote greenery and had not been taxed for the land around the plinth area. But the present tax planning authority has stipulated different setbacks depending on the area of plot and width of road etc.

For houses with larger areas like 50×80, 90×110, 100×200, larger setback areas all around are specified and taxed accordingly as per the latest order. This will send a wrong message, discouraging taxpayers with large open spaces who have already planted trees and raised landscape gardens, forcing them to go for extension of buildings increasing the carbon footprint, the MGP has stated.

It is also observed that clear guidelines are not found in any of the Zones with regard to assessment of tax for car parking areas in houses and apartments (cellars), (live case in Ward 18, Zone 4) where assessments have not been made for the past three years as 50 percent of value of flat/plinth area is not considered, as per practice in Bengaluru and guidelines of the Government. In the guidance notification for Bengaluru city and Ramanagara districts, clear guidelines are issued for assessment area and computation of Property Tax and Cess.

Recent Comments