Mysuru/Mysore: Former President of Federation of Karnataka Chamber of Commerce and Industries (FKCCI) Sudhakar S. Shetty has stated that the recently presented Union Budget gives a modern touch to the taxation system.

He was speaking at ‘Budget Talk-2020’ (on Union Budget), an event organised by Mysore Chamber of Commerce and Industry (MCCI) and Pooja Bhagavat Memorial Mahajana Post Graduate Centre at the Centre premises on KRS Road in city on Tuesday.

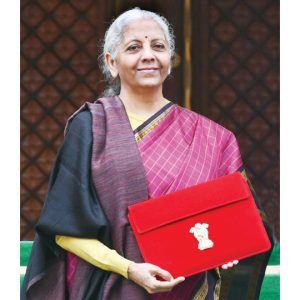

He said that Finance Minister Nirmala Sitharaman has initiated several reforms in banking and financial sectors and has adopted technology to provide solutions to banking and other financial hurdles. He added that the budget had far-sightedness and lays a firm foundation for a robust economy.

“No budget can make everyone happy and a budget gets publicity only when people find fault in it. Allocation to various heads in the budget are good but the results will depend on implementation,” he said.

Chartered Accountant and co-chairperson of Women Entrepreneurs Committee of FKCCI Annapurna Srikanth said India is a highly tax-evading nation and thus, a section of traders and industrialists resisted the implementation of Goods and Services Tax (GST).

“GST has eased the indirect tax regime and promoted uniformity across India, despite a few changes in a few States and Union Territories. It has promoted transparency and accountability. Now, almost 80 percent of the Government’s revenue comes from GST and allied taxes. The Union Government is responsive to the problems expressed by the stakeholders and has made changes. The loopholes also have been plugged,” she said.

Chairman of Confederation of Indian Industry (CII), Mysuru Chapter Bhaskar Kalale said it is everyone’s responsibility to contribute to the growth of the nation. “Budget-2020 has a long-term vision and is part of the objectives of doubling the income of farmers by 2022 and to make India a 5 trillion dollar economy by 2024. But, the goals cannot be achieved, unless the people change their attitude and contribute towards them,” he added.

President of Mahajana Education Society T. Muralidhar Bhagavat said, the budget is ‘real and realistic’. “The Government is serious about the process of cleansing the system and the budget is its extension. Tax planning is good for the individual and also society but tax evasion is bad for both. Each person should pay his or her taxes promptly to be safe,” he said.

Corporation Bank Deputy General Manager C.V. Manjunath, MCCI President A.S. Satish and others were present.

Recent Comments